How do we make the Hawaii energy picture, and our futures, better?

I sense that young folks know something needs to change in our modern world. And I see lots of folk helping each other cope.

This is all very encouraging, so I want to have a conversation: What can we do to make things better for all of us? I’m going to be posting about this in the next few weeks.

I’m going to talk about it being important that we take care of ourselves here in Hawaii, because nobody else is going to worry about us. In a world of declining energy, the pie is getting smaller and everybody is jockeying and fighting for a smaller piece of pie. This is when you get discontent. Look, for instance, at the current presidential election.

But the solution is not fighting with each other like what’s going on right now. The solution is helping each other.

The bottom line is that in whatever we choose to do, the pluses have to exceed the minuses.

This is why I look at the Thirty Meter Telescope (TMT) as a plus. It supports education, and that helps us develop new technologies. Technology is not energy, but it helps us to extend energy. Also, investment in the TMT is all coming in from foreign dollars, instead of us taxing ourselves. All pluses.

Another thing we have that’s clearly a plus in terms of energy is geothermal. We will be over the “hotspot” that provides us with geothermal energy for 500,000 to a million years. That isn’t going away. A huge plus.

And GMOs are a plus because they help us find different ways to keep feeding ourselves, which of course is critical.

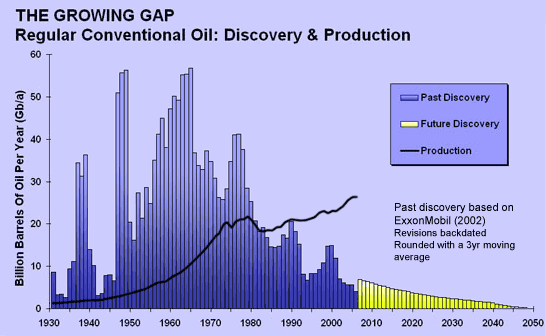

This is what it all boils down to. This is the graph that changed my life.

I first saw it during the 2007 Association for the Study of Peak Oil conference in Houston. It shows, simply, that we have been using much more oil than we’ve been finding.

Obviously there will be consequences if we don’t either:

- conserve what oil we have

- find affordable alternatives

- or use technology to extend what energy we have.

It takes energy to do work and Gross Domestic Product (GDP) is a measurement of work, so this graph implies the world GDP may be challenged if we don’t find alternatives.

It was clear to me that this was going to be the biggest challenge facing Hawai‘i.

I continued studying this and also attended four more ASPO conferences. And I realized I was the only person from the state of Hawai‘i that was attending these conferences and hearing all these experts, and Hawaii energy became my kuleana. It’s not that I wanted it or needed it; I just felt stuck with the knowledge and knew I had to do something with it.

My friend, Professor Charles A.S. Hall, who is known as the father of Energy Return On Investment (EROI), was someone I found clear and easy to understand.

What it’s about and what we can do

I am going to revisit a lot of what I’ve learned since I started studying about this problem in 2007, and write about it here. For example, it takes energy to get energy (for example, to get oil up out of the ground) and net energy is decreasing as we use increased amounts of energy to access more difficult sources.

Is it surprising that World GDP is lessening? Not many of our leaders seem to be paying attention to these things.

So to get back to my question above: What changes can we make? What can we do to make things better for all of us?

People have ideas, and I’m going to write some posts about what makes sense to me (and others). Stay tuned.