Richard Ha writes:

We all admire Mark Dunkerley, President and CEO of Hawaiian Airlines, and wish Hawaiian Airlines the best.

From Pacific Business News:

Speaking to a room of movers and shakers from Hawaii’s commercial real estate industry at the NAIOP Hawaii

Real Estate Symposium Friday at the Hawaii Convention Center, Dunkerley noted that without new product, such as hotels, tourists will eventually go elsewhere for their vacations.

Dunkerely says that Hawaiian Airlines, a subsidiary of Hawaiian Holdings Inc. (Nasdaq: HA) is doing its part by investing $11 billion in a “superior fleet.”

But Dunkerley and Hawaiian Airlines cannot do everything by themselves to save Hawai‘i.

It certainly won’t help if we increase the cost of doing business in Hawai‘i.

The Consumer Advocate is suggesting that O‘ahu (electric) rate payers subsidize the $200/barrel cost of biofuel proposed to be produced by Aina Koa Pono (AKP) in Ka‘u on the Big Island.

From the PUC Docket 2012-0185:

Q. HELCO AND HECO RECOMMEND THAT THE COST DIFFERENTIAL BETWEEN THE BIODIESEL AND THE FOSSIL FUEL THE BIODIESEL REPLACES SHOULD BE

SPREAD ACROSS BOTH HELCO AND HECO RATEPAYERS. IN YOUR OPINION, IS THIS JUST AND REASONABLE?

The Consumer Advocate responds:

A. No. In my opinion, the entire cost premium differential should be borne by HECO ratepayers. I refer to it as a cost premium, because the price of biofuel is currently higher than the price of petroleum diesel.

O‘ahu hotels already pay high electricity costs. Let’s not price them out of the market. This does not help our tourism industry, Hawaiian Airlines or us.

For Big Islanders, our worst fear is that AKP is approved by the Public Utilities Commission. If that were to happen, we would be locked into a 20-year contract that would preclude our selecting lower cost alternatives for 1/3 of our base power electricity use.

An oil price of $200/barrel will be very damaging to the airline industry, as well as to our tourism industry.

We don’t need to be paying for $200/barrel biofuel now when we don’t have to.

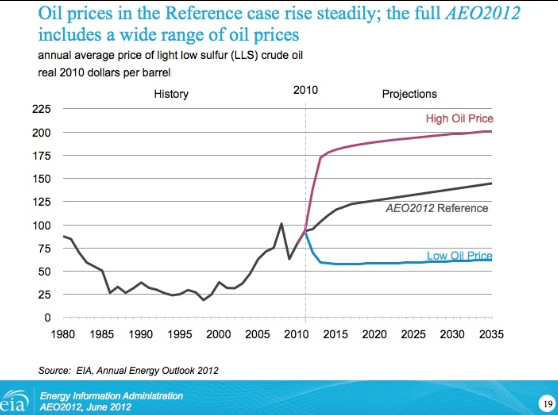

The Energy Information Agency (EIA) projects oil will cost less than $150/barrel in their reference rate case during the 20-year period of the potential AKP contract.

Yet HECO chose to use the EIA’s highest rate scenario of $200/barrel.

What if they are wrong?

Why are we pursuing this alternative? It’s like we are choosing to go over the cliff now, in order to maybe prevent going over the cliff

later.

Why do we want to be first in the world to achieve cellulosic biofuel? There is a 90 percent chance of failure! It would be far smarter to copy someone else who is the first in the world. Then there would be a 90 percent chance of success.

• Are we pursuing this to stimulate economic activity? That’s just taking out of one pocket to put into another, and causing electricity rates to rise as we do it.

A rising electricity price acts like a giant regressive tax. Folks who can afford to do so leave the grid. And those who cannot leave, pay even more.

Two-thirds of our economy is made up of consumer spending. If folks had discretionary income, they would spend it, businesses would hire and people would have jobs.

The opposite is what’s happening now.

• Or are we pursuing AKP to better the lives of future generations? This proposal worsens the prospects for future generations.

We cannot let AKP pass. It would be a disaster for our economy for the next 20 years and beyond.