I helped arrange for Nate Hagens, a well-known speaker on “big picture” issues facing human society, to speak at UH Hilo on Tuesday, January 12th. He’ll be at UCB 100 at 6:30 p.m. His talk will be about how we can cope. Here is a short preview of what he will discuss:

I want to share an article of mine that ran in the Huffington Post last April. It’s about the people I turn to regarding energy issues, and they remain the same.

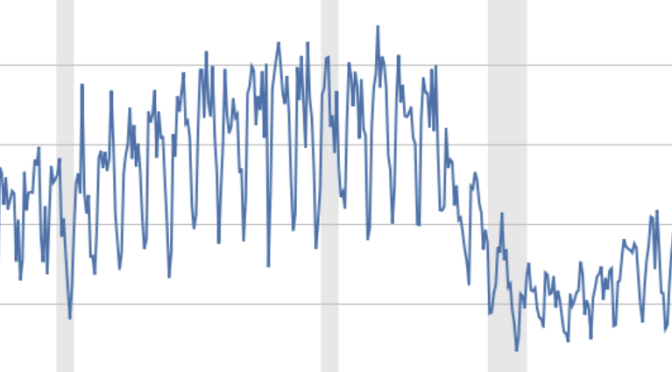

Before I rerun it for you here, I’ll add that the fracking revolution, which no one saw coming, caused the oil price to plummet a year ago. But as Robert Rapier points out, we are very close to the bottom of the oil cycle, and we are likely going to repeat the cycle.

And here is that look back at the Huffington Post article (4/1/2014):

The People I Turn to Re: Energy Issues

It is clear to me that the most important issue we face here on the Big Island right now is that of energy costs. There is a huge risk associated with the rising price of oil, it’s going to affect us all, and we don’t have the luxury of time to deal with it. We need to figure it out now.

We have resources here and ways to address this. It’s not rocket science. It’s all a matter of cost and common sense. What I find is that the rubbah slippah folks get it quickly.

It comes down to a matter of attitude. Instead of being the people who look for a thousand ways why, “No can!” we must become people who look for the one reason why “CAN!!”

Energy issues are completely interconnected with agriculture — together, they all lead to our food security, or lack thereof — and I appreciate all the supportive testimony from so many people re: my renomination to the state Board of Agriculture. Here is a full list of the testimony, which includes support from some of the very knowledgeable people I turn to to learn about and confirm information about energy issues.

If it sounds like I know what I am talking about re: energy, it is because I have spent a lot of time at conferences and also learning from these experts, whose testimony you can read at that link above:

#7 Mayor Billy Kenoi. Mayor Kenoi recognized early on that geothermal would play a crucial role in our energy future and that’s why he helped the Geothermal Working Group, authorized by SCR 99, accomplish its work. I was part of a delegation he took to see geothermal operations at Ormoc City, Philippines. We visited a geothermal plant sited on the flanks of a volcano that last erupted 100,000 years ago. (In comparison, Mauna Kea last erupted 4,000 years ago and so is likely an even hotter spot for geothermal.) The mayor also formed a task force to evaluate the health effects of geothermal on the community.

#204 Henk Rogers. Henk is founder of the Blue Planet Foundation and understands and appreciates the potential of geothermal base power energy. He operates his own grid at Pu’uwa’awa’a Ranch. He also has a fully functional hydrogen refueling station on site. Hydrogen fuel cell cars are coming to the Big Island. Henk is a doer more than a talker. When he does talk, it’s likely to be with the King of Bhutan or Sir Richard Branson about energy issues.

#89 TJ Glauthier has operated at the highest level of our national government. He was second in command in the Department of Energy in the Clinton Administration. His list of accomplishments is so long that when I introduced him to the senior assets managers at Kamehameha Schools, I did it like this: TJ has an extremely long list of accomplishments but let me just describe him this way: He is a “good guy.” That’s all I needed to say. Here in Hawai’i, we all know what that means. He is a good friend and we are in constant contact.

#257 Robert Rapier. Like Mayor Kenoi, Robert Rapier is a “scrappah.” His was the lone voice that opposed Vinod Khosla’s biofuel projects because the net energy did not add up. Several hundred million dollars of subsidies later, Robert proved to be right. He knows his stuff. He has actually operated industrial-scale chemical plants, and yet he can explain scientific concepts in a way that is easy for the layman to understand. I can call him at all times of the day or on weekends. We have become good friends.

#82 Nate Hagens. Nate was editor of The Oil Drum blog, where academics, oil industry professionals and investors came to see what was new. If you participated, you had better know what you were talking about. These folks did not suffer fools lightly. The Oil Drum did not stop publishing because Peak Oil was dead; I think it stopped because we know all we need to know. Now it’s time to do something about it.

Charlie Hall. (See his testimony at this post.) Charlie Hall is a world-renowned systems ecologist. He does not speak about biology from an individual silo but talks about how it involves energy and its effects on real people. Environmentalists who are not systems-oriented sometimes forget about the effects on people. Charlie is known as the father of modern day Energy Return on Investment (EROI). I helped arrange lectures for him to speak at UH Hilo as well as UH Manoa. His wife Myrna, Charlie and myself have become good friends.

#84 Gail Tverberg. Gail is a former insurance actuary whose job was to price risk. She has a stark view of the future. Although I cannot find fault with her view of things, I am the eternal optimist and spend my time looking for workarounds. Gail wrote in support of our Big Island Community Coalition’s efforts to lower electricity rates. (As it turned out, we were successful in defeating the Aina Koa Pono biofuel project, which would have cut off options for lowering our electricity rates.) I helped bring Gail to Hilo for a presentation at the Hilo Hawaiian Hotel and spent a whole weekend taking her family around the Big Island. I asked her a million questions.

I wrote this in November, and it’s still true. From Let’s Adapt to Change and Survive: “Charles Darwin said it’s not the strongest nor the smartest who survive, but the ones that can adapt to change. Let’s survive, and more.”