Richard Ha writes:

Whatever happened to $200 oil?

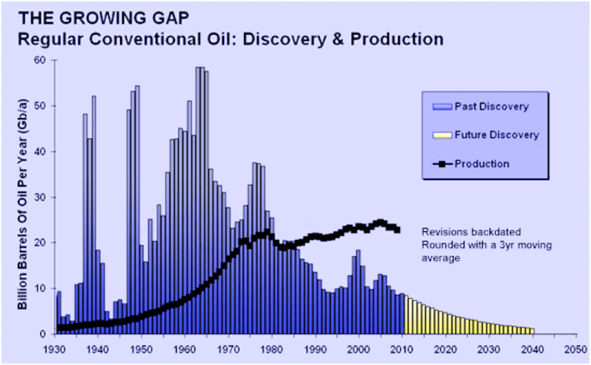

For the last few years, supply side thinking was the most prevalent way of considering the world’s oil supply. But in this last year,

something changed. Commentators started to ask about the demand side.

Specifically, they started asking, “What happens if demand goes up and prices start to rise – eventually killing demand?” In that scenario, the rising price of oil contains the seed of its own destruction.

In May of this year, Jeff Rubin, who had been the most outspoken expert warning of $200 oil, changed his mind. He calls what is happening “the end of growth.”

Whatever Happened to $200 Oil?

by Jeff Rubin on May 23rd, 2012

Four years ago, when I was still chief economist at CIBC World Markets, I forecast that global economic growth was on pace to send oil prices to $200 a barrel by 2012. In short, the argument was based on a supply-driven analysis that weighed the sources of future oil supply against the prices that would be needed to make the extraction and processing of that oil economically viable…. Read the rest

If Jeff and many others are right, we are not looking at a rapid climb of the price of oil to $200/barrel. It may not get to that price for 20 years.

And if that’s true, HECO’s request to pay $200 per barrel for Aina Koa Pono’s biofuel will be a tremendous mistake. All that will be

accomplished is a massive transfer of wealth.

This is why I am so pleased that Kamehameha Schools (on the

recommendation of Neil Hannah, Kamehameha’s Director of the Land Assets Division) is sending two senior level management folks to the upcoming Peak Oil conference. Things are moving quickly in the world energy field, and policy makers need to be up on current information.

That HECO is betting on the high side of the 2012 AEO cost curve shows they are not aware that thinking has changed. Had they sent people to past Peak Oil conferences, they would have seen the shift.

Including myself, there are now five people from Hawai‘i going to the ASPO conference. We have the makings of a delegation. Robert Rapier will also be going, too, but I am not counting him because he is a national/international commentator and he will be presenting.

This will be my fifth ASPO conference. I cannot be happier that there are other people from Hawai‘i going, besides myself, and educating themselves on this very important subject.