It was a hard-working

horse, they said, and it would not cost us much money.

All our problems

would be solved, they insisted, if we just had this horse.

And from the back

end, it did indeed look like a horse.

They said we couldn’t

look at the horse’s face, though, for competitive reasons.

It wouldn’t be fair

to the other horses, they said.

We searched and

searched through the scrolls,

and we realized that

all was not what it seemed.

Their “horse,”

it turned out, was actually a unicorn.

One of their friends

spoke up.

“What if we gave you

the uni….er, I mean the horse, for free?

What if we made

people from the land of O‘ahu pay for the horse?”

We said, “No. The

unicorn spends more time eating than working.”

Someone shouted, from

the back of the great hall,

“Don’t believe them!

They want to take over the kingdom!”

We replied, “No! We

just don’t want to take care of a unicorn.

A unicorn does not

help our people. It eats too much and takes up too much land.

We worry about having

enough food for the most defenseless among us.”

And that, Boys and Girls, was the start of the Rubbah Slippah

Revolution.

HECO and Aina Koa Pono (AKP) both issued glowing press releases

about the AKP project. But neither would say how much AKP would be paid for its

biofuels. They said it was a secret – to protect other bidders.

They said that the average ratepayer would only pay about $1

more per month, and that this would only go into effect if AKP was successful

in producing biofuel. They said it would mean several hundred new jobs, and

lots of money would be saved by not importing oil.

The project anticipated supplying HELCO’s Keahole 80MW plant

with most of its liquid fuel needs. That would be roughly 16 million gallons

annually, plus another 8 million gallons for transportation fuel.

HECO was not being fair when it would not give price

information and yet did predict that this would be very inexpensive to rate payers

– basing all this on assumptions and secret information.

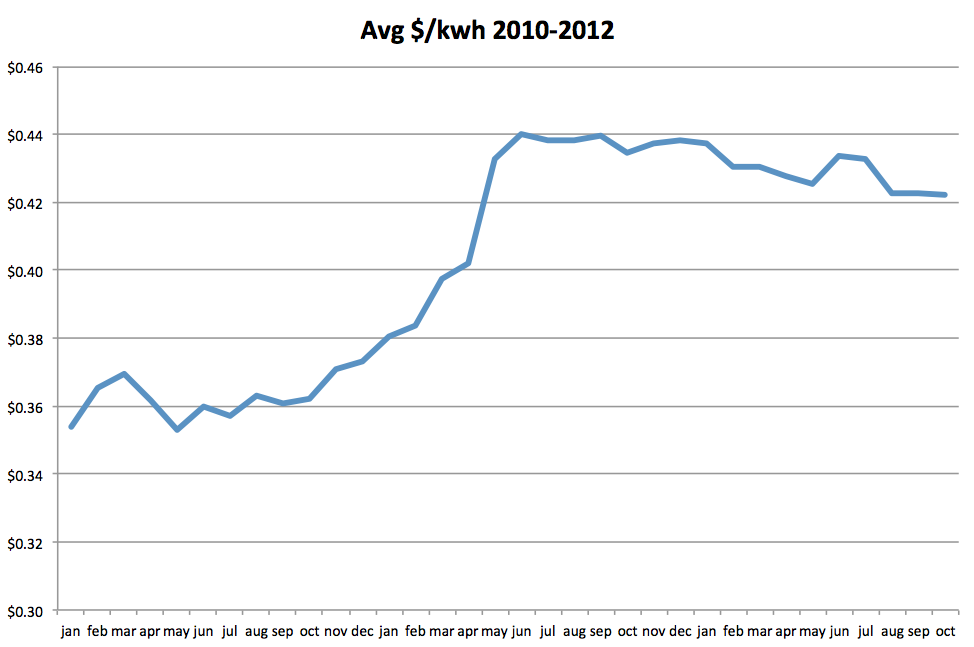

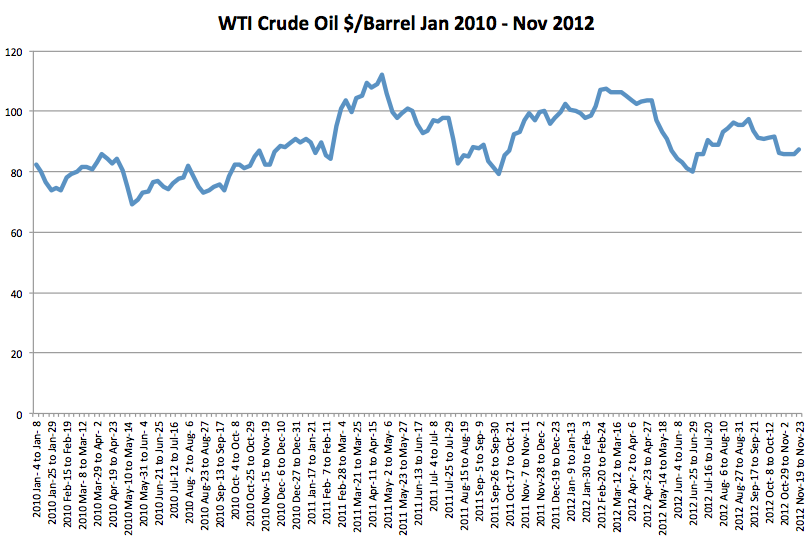

The cost of the biofuel the rate payer would subsidize, it

turns out, is around $200/barrel. This is not a small amount. By assuming that

the price of oil would be close to $200, HECO could then say that this project would

not cost the ratepayers substantially more than what they would be paying

anyway.

Try wait! No amount of public relations will earn back the

credibility lost because of this unfair assumption.

Also, AKP says, the microwave technology they plan to use has

been successfully and safely used in the herbal extraction and pharmaceutical

industries for decades.

People who know tell me that this statement is like someone

with a Piper Cub pilot’s license offering to fly you to the moon sometime in

the future. But at least this one is a claim we can research.

Both the Hilo and Kona PUC hearings made clear that the

people are vehemently against the Aina Koa Pono project. At the Kona hearing,

the Consumer Advocate asked whether people would be in favor of this project if

all the costs were paid by O‘ahu rate payers. I think the logic was that O‘ahu

residents should pay for this, because it helps O‘ahu fulfill its part of the

Hawaii Clean Energy Initiative mandate for renewable energy.

Doesn’t each island’s contribution apply to the whole state?

Try wait!

AKP claims that it’s a fact that Keahole will be using

liquid fuel far into the future.

We don’t agree that we should favor AKP’s 20-year contract,

because it precludes using lower-cost alternatives; for example, natural gas

and other technologies that are being fast tracked, such as ocean energy.

Take geothermal as an example. Generating electricity at today’s

prices using geothermal costs 11 cents/kilowatt hour less than oil. Output at

the 80MW Keahole plant (which is equivalent to 80,000 kilowatts) times 11

cents/kilowatt hour is equal to saving $8,800/hour, $211,000/day and $77

million/year. That amount of savings could pay off the potential stranded asset

and also save the rate payer money.

The barrel equivalent of geothermal is $57. Why would we

want to tie ourselves to a $200/barrel and a 20-year contract?

Aina Koa Pono says it will, on its 12,000 acres, produce 24

million gallons of fuel per year. That’s roughly 2,000 gallons of biofuel per acre,

which is four times more productive than palm oil, the only biofuel that can

compete with oil. Yet they plan to do it with an undetermined species of grass.

Ka‘u Sugar Company, in the projected area of Aina Koa Pono,

grew sugar cane and was one of the least productive sugar companies in the

state. Sugar cane is a grass.

AKP is not cost-effective and it doesn’t make sense for us.

We need to concentrate on solutions that better the condition of our people.

If you agree and would like to let the PUC know, this is the time. You can write to the PUC before November 30th at Hawaii.puc@hawaii.gov, and refer to “PUC Doc 2012-0185-Application for biofuel supply contract.”