A proposed biofuels project that Hawaiian Electric Company (HECO) supports is going through PUC approval process right now.

HECO’s public relations people say that as a result of this new project going through, the average Hawai‘i rate payer’s electricity bill would increase by only about $1 per month.

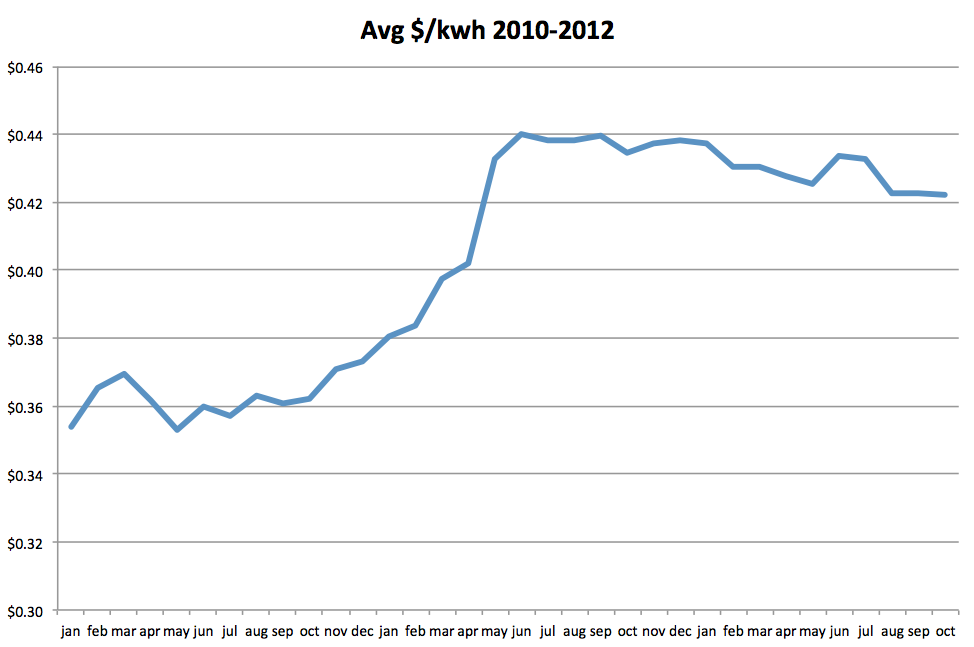

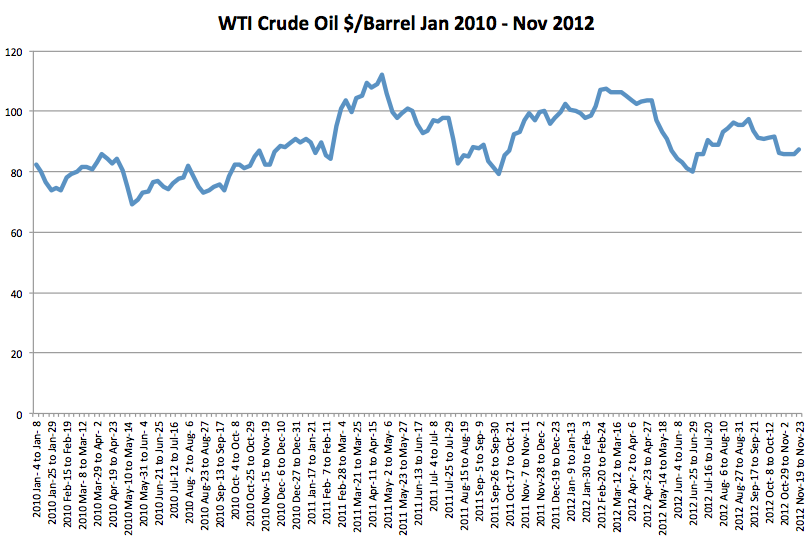

But let’s look at that in a little more depth. HECO is seeking approval to pay Aina Koa Pono (AKP) $200/barrel for the biofuel it produces on the Big Island at Ka‘ū, and would pass on any extra cost (beyond what oil actually costs at the time) to its rate payers, both on the Big Island and on O‘ahu.

HECO has kept that $200/barrel price secret – they are still keeping it secret – but the Big Island Community Coalition folks figured out the price, and how the “$1/month rate increase” was determined.

Using the Energy Information Agency’s (EIA) Annual Energy Outlook (AEO-2012), one can see that HECO is using the highest price scenario, which projects an oil price close to $180/barrel in 2015. In the AKP discussion, it was said that the price of oil would exceed the actual price projected at the end of the period.

We can see that the line hits $200/barrel in 2035. Since they assume that oil will be $180 in 2015, they can therefore say that the difference (between the actual and projected price) would be very small: Hence, an increase of only perhaps $1/month for the average rate payer.

However, it follows that if the actual price of oil is much lower than $180/barrel, rate payers will be paying the difference between that amount and $200. What if the actual cost of oil in 2015 is $120/barrel? That would cause rates to go up much more than $1/month – especially for high-power users.

I cannot help but think that HECO is damaging its credibility immensely by pushing this project. HECO is spending hundreds of

thousands of dollars on public relations to convince us that it is trying to lower people’s rates – when, in secret, it appears to be doing exactly the opposite.

By the way, HECO says the hundreds of thousands of dollars it spends on PR comes from its shareholders. How can rate payers tell when HECO is speaking on behalf of its shareholders, and when it’s speaking on behalf of its customers?

This Aina Koa Pono project needs to be rejected because it will make our electricity rates rise. Rising electricity rates act like a giant regressive tax, because as folks who are able to leave get off the grid, those who cannot afford to are left to pay for the grid.

This results in farmers and other business folks having higher operating costs. For everyone else, it takes away discretionary income. And we know that two-thirds of our economy is made up of consumer spending.

There are also problems with the project itself. Fuel has never actually been produced using the process and feedstock that Aina Koa Pono proposes. AKP does not know what it is going to grow. So far, the feedstock it is testing experimentally is white pine. The Micro Dee technology that AKP wants to use is still experimental.

There is also a risk that this process might use more energy than it generates. Generating electricity is generally about boiling water and making steam that turns a turbine. It is cheapest to burn the stuff, boil water and make steam.

But Aina Koa Pono’s proposed process is extremely energy-intensive and expensive: It would make electricity to make microwaves to vaporize the cellulose to get the liquid and then take the pyrolysis oil, refine it to make it burnable, and then haul it down to Keahole in tanker trucks to make steam. Why should the rate payer pay for all that?

Cellulosic biofuels are not yet a cost-effective technology. On the mainland, in the middle of last year, the Environmental Protection Agency drastically decreased its 2011 estimate for cellulosic biofuel from 250 million gallons to a paltry 6 million gallons.

In 2010, cellulosic biofuel companies on the mainland needed to buy their feedstock for $45/ton. But because farmers were earning $100/ton for hay, the biofuel firms received a $45/ton subsidy.

I asked how much AKP expected to pay for feedstock, and the AECOM Technology Corporation consultant said between $55 and $65/ton. The problem there is that Hawai‘i farmers have been earning $200/ton for hay for 10 years now.

There is an agricultural production risk, as well. Palm oil is the only industrial-scale biofuel that can compete with petroleum oil. AKP has 12,000 acres and it says it will produce 18 million gallons of biofuel annually, and another 6 million gallons of drop-in diesel. So it will produce 24 million gallons using 12,000 acres. That is 2,000 gallons per acre, and that is four times the production of palm oil. More likely they would need at least four times as much land, or 48,000 acres. But where?

Consider too that Ka‘ū Sugar relied on natural rainfall, and it was one of the least productive of the sugar companies. There is a drought right now. And at 22 degrees N latitude, the area has less sun energy than the palm oil producers located on the equator.

According to Energy Expert Robert Hirsch, in his book The Impending World Energy Mess, the best model for biofuel production is a circular one, where processing is done in the

center of a field (which does not exceed a radius of 50 miles) consisting of flat land and deep fertile soil with irrigation and lots of sun energy. This situation exists in Central Maui, where Hawaiian Commercial & Sugar Company (HC&S) is located. It explains exactly why HC&S is the sole surviving Hawai‘i sugar plantation.

To compete heads up in the world market would require the best possible combination of production factors. These are not them.

It’s also important to consider that locking ourselves into a 20-year contract now would preclude lower cost alternatives. Geothermal, for example, is the equivalent of oil at $57/barrel. Ocean thermal has the possibility of being significantly lower in price than $200/barrel oil. LNG is on the radar and so is biomass gasification. Who knows what else would come up in 20 years?

Paul Brewbaker and Carl Bonham, both highly respected Council of Revenue members, have said, very emphatically and for a while now, that low energy cost is critical. We should listen to them.

The International Monetary Fund team modeled different oil supply scenarios and did a presentation at the Association for the Study of Peak Oil (ASPO) conference a month and a half ago. They could not model a constant $200/barrel oil. Those would be uncharted waters; and ones, by the way, that would devastate Hawai‘i’s tourist industry. Why should we start paying $200/barrel for oil in 2015 if we don’t have to?

Five people from Hawai‘i attended this year’s ASPO conference. Notably, Kamehameha Schools sent two high-level people. Next year, Hawai‘i should send 20 people to learn what’s happening with oil prices and energy.

In the meantime, the amount of risk involved in the AKP biofuels proposal is just far too great. In the investment world, reward is generally commensurate with risk. Except for protection from $200/barrel oil in later years, the AKP project would provide little reward for all the risk we rate payers would assume.

This is a very, very bad deal for consumers.

Big Island electricity rates have been 25 percent higher than O‘ahu’s for as long as anyone can remember. This probably adds to the reason why the Big Island has the lowest median family income in the state, as well as the social ills that go with it. We need lower rates, not higher rates!

Although this is not an official Big Island Community Coalition (BICC) communication, I would like to point out that the BICC has been very instrumental in getting lots of people to stand up and say, “Enough is enough.”

The BICC is a bare-bones, grass roots citizen group with some of the most recognizable names on the Big Island on its steering committee: Dave DeLuz Jr., John E K Dill, Rockne Freitas, Michelle Galimba, Richard Ha, Wallace Ishibashi Sr., Ku‘ulei Kealoha Cooper, D. Noelani Kalipi, Ka‘iu Kimura, Robert Lindsey, H M Monty Richards, Marcia Sakai, Kumu Lehua Veincent and William Walter.