Richard Ha writes:

Here’s another testimony opposing the Aina Koa Pono biofuel project. This one is from Bill Walter.

You can send an email opposing this project. Email it by this Friday, November 30, 2012, to hawaii.puc@hawaii.gov.

To: hawaii.puc@hawaii.gov

Subject: AINA KOA PONO CONTRACT

Please consider my testimony on : DOCKET # 2012-0185 (Aina Koa Pono supply Contract)

AINA KOA PONO, LLC

Docket # 2012-0185

In this docket, HELCO is asking you to validate its proposed contract with AKP, passing on the expected additional cost of the project in the form of a surcharge to rate payers on both Oahu and the Island of Hawaii.

It is difficult, sometimes, to imagine a decision of this nature on the basis of the economics of the case itself.

To help us with this, AKP’s PR firm has reduced the numbers to minimize the apparent impact of the decision – simply add $1 per month to your power bill for 20 years or a total of $240. Seems pretty small, not much of a decision or even much of a risk when put in these terms. Of course this picture does not paint the costs as they apply to thousands of businesses, non profits, government entities or other organizations. Neither does this demonstrate how those costs ripple through the economy to increase costs of goods and services while reducing the supply of the same. So, lets look at this from three other perspectives before we get further into the discussion. Those three perspectives are of a family barely making ends meeting (and actually not making it accept with government and family help); a family that makes ends meet but with some sacrifices and finally a family that has plentiful resources and buys whatever luxuries they desire. But lets change the terms – to the cost of fuel for these three families.

•Ask yourself, if you were the first family if someone offered to sell you gas for the next 20 years – starting in 2015 at twice today’s average rate or about $8/gallon and at today’s usage – would you buy this package? Probably not – they are not assured that gas will cost $8/gallon over that period and can see that rather than trade a known (but apparently very high) cost of fuel they would anticipate that they would make yet more lifestyle changes. They would increase car pooling, bus riding, volume grocery buying (if possible), growing more of their own food, etc. THE POINT IS that they truly cannot and would not be able to afford the higher costs and so would take other steps to make ends meet. In the same way, to families at the bottom of the economic ladder the AKP deal is something that they cannot afford and never would select.

•If you were in the second group the situation may present itself differently, but in this case you may have more options. For instance, rather than locking into $8/gallon and at today’s usage you may decide to buy a more fuel efficient car; combine trips; consider other transportation (bikes, walking, carpooling, bus trips, etc.) reducing steps. The point is that you would have more means of reducing usage so that the $8/gallon could take you further. It is not likely that you would take the deal as presented. You have too many assured usage reducing options and too little assurance that the price will actually reach $8/gallon.

•If you were in the third group you still might not buy into the proposition. Your ability to purchase more efficient transportation -or even ignore the problem because fuel may not reach that level – is greater, the impact less.

So then, the point is that very few would even consider the option being proposed by AKP if it were put to them in terms that they work with every day. Neither should the PUC.

These scenarios may have little impact on your decision, after all your decision is really on a macro level dealing with a large company, sophisticated planning and island wide demand. For this I ask you to consider the following:

IS THE PROPOSITION REASONABLE AND IN THE PUBLIC INTEREST:

•If there are other alternatives for providing power to the Island of Hawaii that are or are likely to be less expensive then the answer is clearly “no.” Why pay more to achieve the same result (power generation) when less expensive sources are or can with a similar degree of confidence be expected to be available. So the question, then, is – are there?

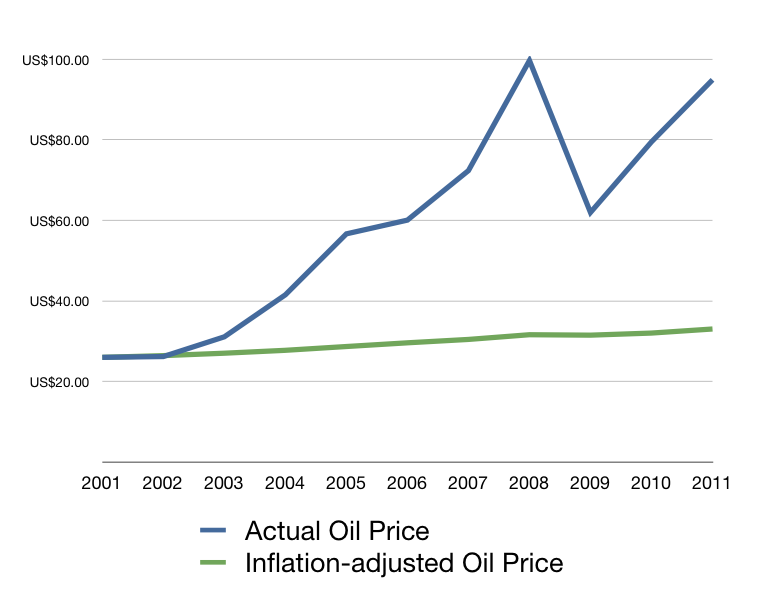

• AKP’s contract appears to call for fuel at $200/barrel vs. today’s rate that bounces somewhere between $80 and $120 (but generally near the mid point – $100).

• PGV is able to produce power at the equivalent of $57/barrel – 28.5% of the cost of AKP’s proposal. This is produced with reliable and proven technology here on the island of Hawaii. it produces less carbon in the process and is a known quantity.

• LNG is proposed as a possible alternative, In fact we are told that many mainland power producers are turning to this source from coal and petroleum products. They do so because of efficiencies and reduced dependance on foreign sources. Would it not make more sense to at least wait to see what studies show the impact of LNG would be on our power costs before committing to a 20 year contract based on much higher prices?

• Ho Honua proposes to sell to HELCO at market rates. Others are taking similar risks to produce fuel at market rates – whatever they may be – even at today’s rates (i.e. Big Island Bio-Diesel).

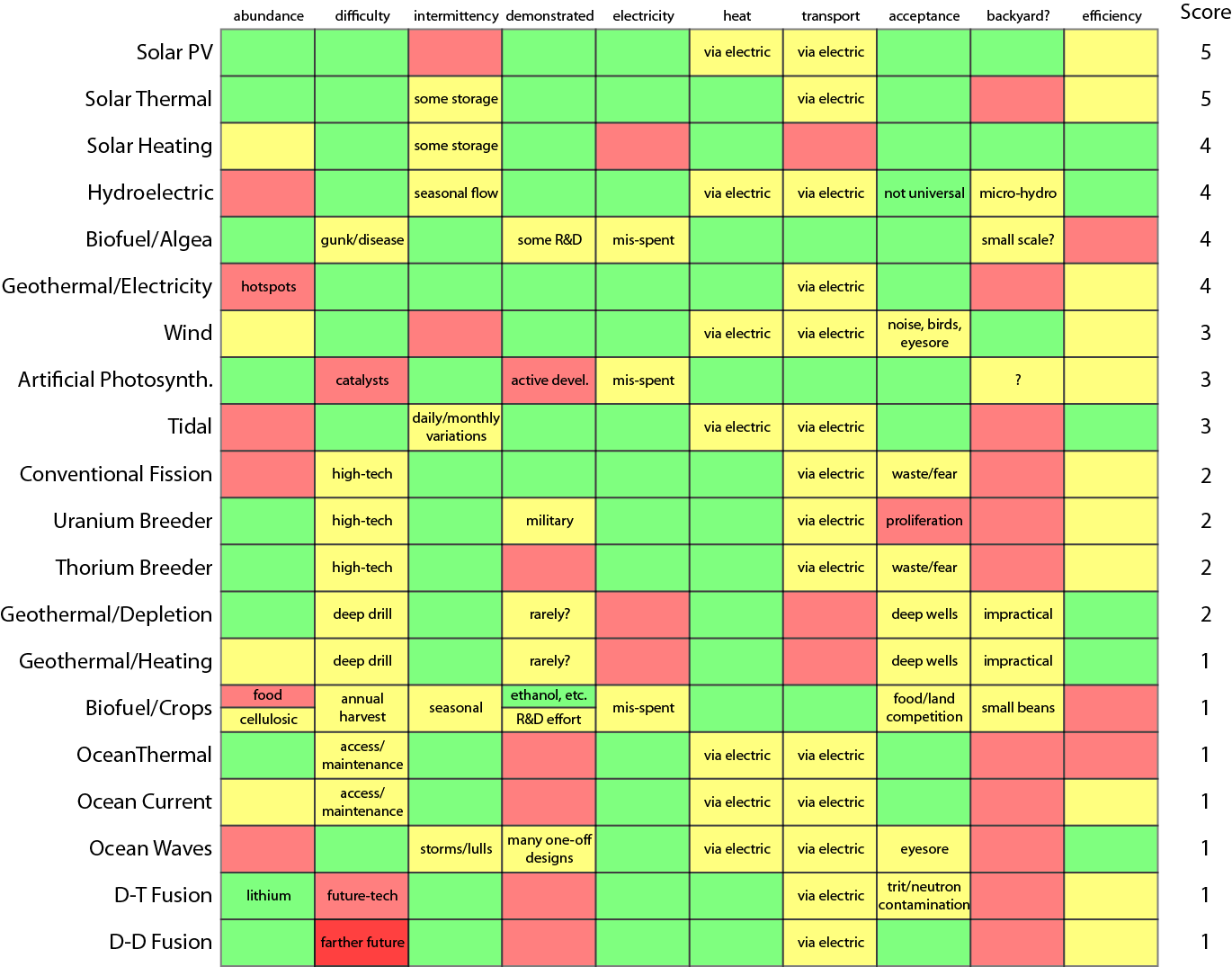

• Other technologies are coming on stream that promise reduced power generation costs as well – solar energy or various types, bio-fuels from algae, wave action, etc. Why lock in a supplier whose promise is similar fuel but at higher prices.

•HELCO/AKP counter that if the fuel does not end up being economical – they can sell it to transportation or to other islands for their power generation. But that assumption is based on the AKP created fuel being less expensive than fuels from other sources. If it is not – then HELCO sells those fuels at a loss which the rate payer must subsidize. In short – the risk remains

•This proposal is truly a gamble not simply on the cost of fuel over the proposed period (2015 – 2034) but on the cost of alternative fuels, alternative sources of power and even over whether the target plant (Keahole) will be economically viable throughout this period. We would ask: WHAT MITIGATING FACTORS WOULD DRIVE US TO MAKE THIS GAMBLE – particularly as we consider the impact on the lives of our residents and their businesses.

WHAT QUANTITATIVE OR QUALITATIVE VALUES SHOULD BE ASSIGNED TO SUCH A PRICE PREMIUM OR EXTERNALITIES

•This is a vital question. It needs to be evaluated in its full context which includes: individuals at the lower end of the scale who cannot make ends meet today; businesses that will have to increase prices further and reduce product and service offerings further; individuals and businesses who are trying to compete with Oahu and other locations with lower power costs; companies that are evaluating the Island of Hawaii as a location but must take into account the already unusually high cost of power here as one of the deciding factors.

• The end is that many will find that their survival at any reasonable level does not allow for such luxuries as taking the risks this contract proposes. These externalities for those who struggle are too high to pay and not worth the risk.

• For those who may point out jobs to be created in the production of these fuels do not account for the jobs lost throughout the island because of the additional costs of the AKP premium and there surely will be many.

WHAT RATE PAYER RISKS SHOULD THE COMMISSION CONSIDER IN EVALUATING THE BIODIESEL SUPPLY CONTRACT?

•The risk that the market price for fuel will not in the end justify this ($220/barrel) cost

•The risk that other power sources can be developed that will be less costly

•The risk that at each level higher those able to depart from the “grid” do depart from the grid making the remaining – less and less economically capable – rate payers pay a higher and higher proportion of the distribution and generation costs. (This thing steamrolls literally).

HOW ELSE MIGHT THE COMMISSION AND HELCO PROVIDE FUEL TO KEAHOLE

•Dr. Schumpeter more than four generations ago pointed out that market systems need to encourage “creative destruction.” By this he meant that ever more efficient technologies by their nature create higher living standards while making obsolete the technologies that they replace.

This applies as follows: WHEN KEAHOLE is no longer economically viable – it needs to simply cease to operate. This is fundamentally an owner (i.e. stockholder) risk and should not remain a risk of the populace as a whole. We should not be taking extraordinary steps to keep in operation a plant that may have become functionally and technologically obsolete. Whereas there may have been a time when ensuring the viability of the assets of a controlled monopoly made sense – they no longer do.

What happened in the communications industry (i.e. cell phones vs. land line phones) will and is happening in the power generation industry. The PUC must recognize this change or the number of “well healed” customers who depart the grid will overwhelm the entire system leaving only those least able to pay on the grid having to pay for an overwhelmingly burdensome grid.

•There is, nonetheless, more than one answer to this question and arguably all of the other options are less expensive and certainly less economically risky. Keahole may be converted to operate on LNG. AKP is essentially a hedge bet – it may well be that continuing to purchase fuel on the market (whether from local sources, or other sources) will be a less expensive option. We do not know at the moment which it will be, so should we be taking this hedging risk?

OTHER CONSIDERATIONS

•AKP is essentially a complex set of transactions designed to allow HELCO/HECO to meet the State’s goal of reducing dependance on foreign fuel sources while keeping alive Keahole and increasing spot employment among other benefits. This particular scheme appears to have many benefits but at no small risk. At its heart are assumptions about the future price of oil, the capabilities of technologies untested at anywhere near the size and configuration proposed. The commission must ask itself: IS IT APPROPRIATE to ask rate payers – many of whom are at the extreme low end of the economic scale – to participate in the risk? If the answer was that there are really no other viable options the answer may be clearly and easily “yes.” But this is not the reality – there are many other alternatives and most of them at significantly lower cost. Justification for this risk taking is, in fact, scant.

•In the 1970’s the Northwest Utilities made a series of judgements based on expected power requirements and power prices. Prices assumptions were driven at that point by dramatic increases in the price of fuel and by its apparent (but not actual) scarcity. Demand was based on charts showing post WWII growth and regional growth based on increasing industrialization of the area resulting from low power prices would continue on the same upwards trendline. These factors led WPPSS to develop a complex funding scheme to build nuclear power plants. All of this was well meaning and well intentioned. The coming debacle – a $2.25 Billion default – is a classic example of what happens when we add uncalled for complexity based on a future that is much more nuanced than any chart can demonstrate. (One summary of the adventure can be found at http://columbia.washingtonhistory.org/anthology/maturingstate/seduced.aspx) Frankly, although similarly well intentioned and actually less complex – the driving factors for AKP share several of the same characteristics. For a community that is paying 4X the national average for power, 25% more than Oahu for power – this is a risk that a fragile economy simply cannot bear and should not be asked to bear.

Bill Walter