Young people, or anyone concerned about the world we live in and about leaving it better than we found it, should attend Nate Hagens’ talk next month.

Nate Hagens is a well-known speaker on “big picture” issues facing human society.

He’ll be speaking at UH Hilo on Tuesday, January 12th, in UCB 100 at 6:30 p.m.

Nate, who is on the board of the Post Carbon Institute, sent me the following. Have a look to learn a little bit about him and get a sense of where he’s coming from, and what he talks about.

Fifteen years ago I walked away from Wall Street. It was a fun place—I learned a lot, made a good income, and met fascinating people. But as I began to learn that the financial narrative about humans and our planet was a hollow facsimile of the real story, and therefore counterproductive to our real challenges, I quit.

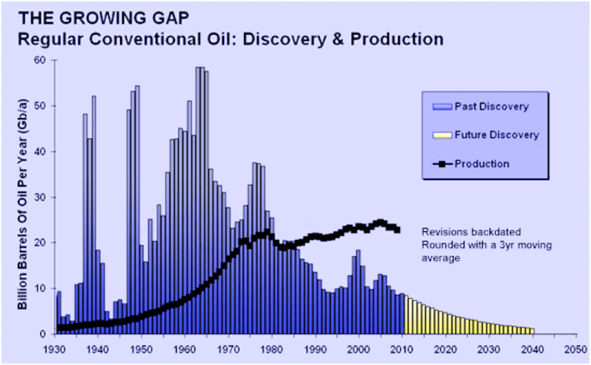

Today I still meet fascinating people—in ecology, neuroscience, paleobiology, atmospheric science, biophysical economics circles, etc. And the collective story they’re telling suggests that we’re in a hell of a pickle. We dominate the planet’s sources and sinks, supported by a virtual army of powerful fossil slaves, who perform about 90% of the labor in our human system. With their help, we have grown our economies (and our impacts) exponentially over the past two centuries.

The largesse that spins off from this subsidy of ancient sunlight provides our wages, profits, jobs, cheap stuff, as well as the ability to do science, strategize about our future, and fund social and environmental initiatives. But, these fossil slaves are tiring (and they poop and breathe, which is of great concern regarding our oceans and biosphere).

The real stock market is our air, our soils, our forests, our oceans, and the biodiversity we share the planet with. This stock market has been in crash mode since I’ve been alive.

Two stock markets—one focused on the agenda of the gene, and one potentially focused by sapient minds. Which one should we focus on?

I currently teach a class called Reality 101 at the University of Minnesota. My students—bright, curious, pro-social 19 year-olds—are coming to understand this broad ecological backdrop. They are aware of—and incredibly concerned about—the loss of our natural world, the end of the kind of economic growth and opportunities that existed a generation ago, and the social angst percolating in our society. They want to make a difference, and somehow avoid the standard conspicuous consumption trajectory, which is to get a salary, follow the rules, pay the bills, and buy more gadgets. So, I struggle with questions like these daily:

- How can we learn to navigate the complexities of a contracting economy, while still including the viability of a natural world as a core goal?

- How can we steer societal values so that young people can hold true to their ideals that manifest the more benign aspects of our species?

- How can social and environmental groups “fighting the good fight” for a livable biosphere and social cohesion stay afloat in what will be increasingly tough economic times?

I have been on the Board of Post Carbon Institute since 2009. PCI uses a small budget and a big heart to achieve significant impact. Of the environmental NGOs, it is the only one that I know that focuses on the challenges our societies will face as our fossil slaves leave us before we might succeed in firing them.

The staff, Fellows and Board Members who comprise the Post Carbon Institute do not offer prescriptions, Instead, we use a systems approach to provide information, analysis, examples, inspiration, and community that remains ahead of the curve of those promoting singular “answers” to societal challenges.

The monetization of the human experience—and its impacts—has metastasized through modern global culture. Anything of value can and is parsed into dollars. And this sets up an irony: there is no financial profit in working on changing the system to something more sustainable, less finance-centric, and more tethered to biophysical realities. The people doing this work depend on those who have some surplus, and who care enough to support these efforts. A pro-social virtuous cycle.

When I was 19 (and naive), I thought “finance” was the key to the future. But I now see that it is ecology. What do today’s 19 year-olds see as their future paths? How will tomorrow’s 19 year-olds define “success” in life? The answer to that begins with education, synthesis, and new stories that we start to tell, today. PCI is poised to expand its reach, with the specific goal of engaging young people to prepare them for the world they will inherit.

If the 20th century was the Century of Self, then perhaps the 21st can be the Century of a Livable Future, which will require sacrifices and creativity from broad swaths of human populations. Please consider personally engaging in this battle of values and vision in the years (and decades) ahead. Choose an issue you feel passionate about, take a deep breath, and get involved.

Put Nate’s talk on your calendar. January 12th. 6:30 p.m.